The 2022 October Federal Budget has been announced. Here’s how the Goldfields and mining are affected.

The migration cap will increase 35,000 persons to 195,000 people in 2022-23. At least 90% of these 35,000 will be for skilled migrants and more than 25% will be targeted to regional areas.

This will ease labour shortages and include accelerating visa processing. Student and secondary training visa holders will have their work restrictions relaxed until 30 June 2023.

In an effort to transform regional industries to net zero by 2025, the Government will establish a $1.9B Powering the Regions Fund to transform Australia into a renewable energy superpower. $1.5B will be allocated to the Pilbara Region to support mining, mineral processing, and local manufacturing, and provide investment in hydrogen and renewable energy projects.

$500M Driving the Nation Fund will reduce transport emissions by installing electric charging infrastructure at 117 highway sites and hydrogen highways for key freight routes. Electric cars will be exempt from fringe benefits tax (FBT) and the 5% import tariff.

$350.0M will be dedicated to seal the Tanami Road between Norther Western Australia and the Northern Territory, $400M for the Alice Springs to Halls Creek Corridor upgrade and $125M for electric bus charging in Perth.

$757.7M will be allocated to improving mobile and broadband connectivity in regional Australia. $7.4B will be invested to support regional development across Australia. The Growing Regions Program will support community groups, fund local projects such as libraries and regional airport upgrades. The Government will also dedicate $1.4B for local community, sport and infrastructure projects across Australia.

$143.3M will be provided over 4 years to support access to healthcare in rural and regional areas by investing in primary care services, training, workforce incentives and trials for innovative models of care.

A $50.5M Critical Minerals Research and Development Fund will invest in lithium, cobalt, manganese, titanium and rare earths to meet growing demands for batteries, electric vehicles and clean technology.

Multinational corporations will pay an extra $1B in tax with the crackdown on excessive deductions and profit-shifting to lower-taxing countries.

Individual taxpayers and businesses will also be targeted with the ATO cracking down on over-claiming deductions and incorrect reporting of income.

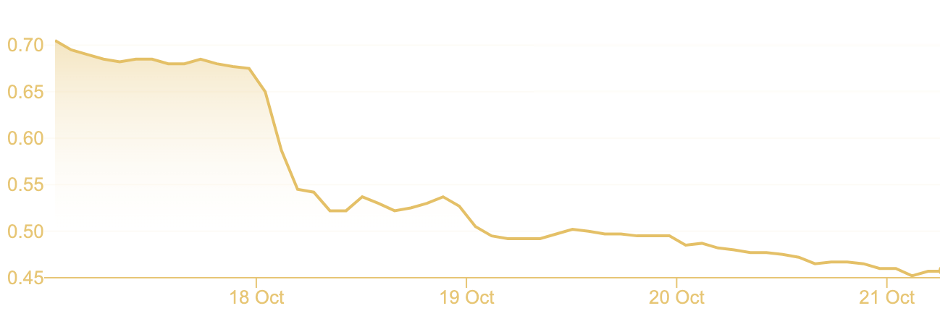

Due to high inflation and low wage growth, worker’s pay will effectively go backwards until 2024-25 when inflation is expected to return to 2-3%. Inflation is expected to peak at 7.75% in December.

The Better Regions Fund (BBRF) was the former Government’s regional grants program designed to deliver funding for regional infrastructure projects and community development activities. The Government scrapped the fund in the budget as they believe the fund wasn’t awarded based on merit and were favouring National Party electorates.

However, the budget includes a new national grants program.

Truck drivers will be hit with an extra 0.8 cents in tax for every litre of diesel they purchase. The Heavy Vehicle Road User Charge will increase from 26.4 cents/litre to 27.2cents/litre.

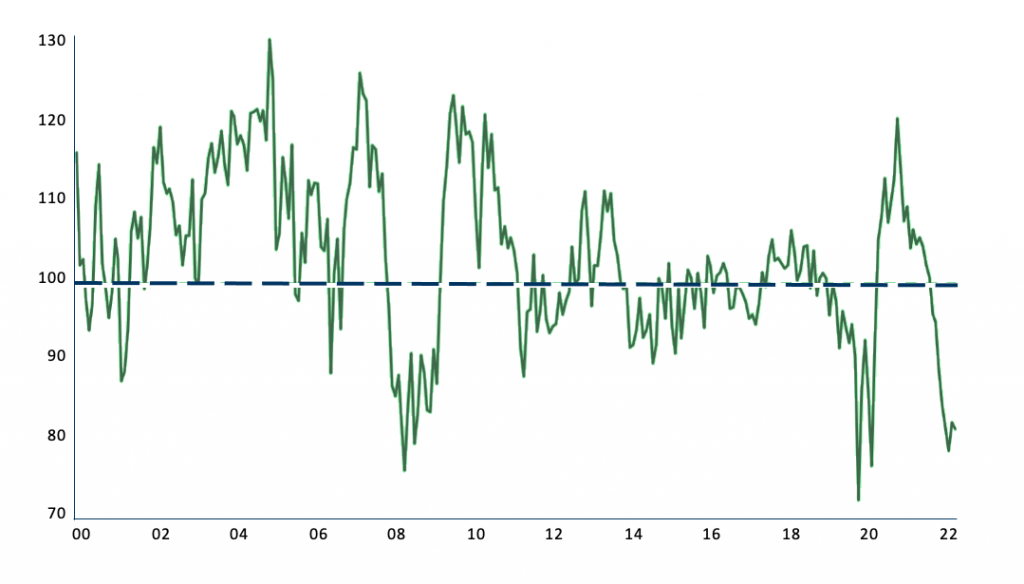

Consumer confidence continues to sit at a low, having peaked in 2021. The current figure is comparable to the start of the pandemic in 2020 and the Global Financial Crisis in 2008.