Hancock Energy has increased its offer to buy Warrego Energy from $0.28 cash per share to $0.36 cash per share, totalling $447m if the offer is approved.

Three of the Four Warrego directors have recommended shareholders accept the deal over an offer made by Strike Energy, offering one Strike share for every Warrego share.

Great Western Exploration will extend its Firebird Gold Project after gold anomalism was found at their Greenstone Belt site, located near Wiluna.

The announcement saw a 4% share price increase for Great Western Exploration to $0.052.

Fortescue CFO Ian Wells has announced his resignation in order to spend time with family and friends.

Wells is the ninth executive in two years to resign, not long after Guy Debelle resigned in November last year.

Wells said that despite his resignation, “Fortescue is in a strong position to be able to deliver on short-, medium- and long-term growth options through the Iron Bridge magnetite project, Fortescue’s decarbonisation, and FFI’s (Fortescue Future Industries) portfolio of opportunities.”

Everest Metals Corporation’s share price jumped 20.87% to $0.110 per share after an initial drilling program at their Mt Edon mining lease saw positive pegmatite levels, causing EMC to push to exercise its exclusive farm-in option to acquire the right to 100% interest in the Mt Edon Project.

Chief Operating Officer, Simon Phillips said “EMC is pleased to announce its decision to exercise its right to farm into the Mt Edon LCT Pegmatite Project, subject to Shareholder approval. The company is pleased to have the opportunity to take the next step towards 51% ownership in a project with such an extensive array of pegmatite outcrops over six kilometres. The recent reconnaissance drill program gave EMC the data it needed to commit to the next stage of exploration at this highly fertile pegmatite field as part of the Company’s commitment to its Battery Minerals project development strategy”

Lithium Power International has commenced its drilling program at its East Kirup Lithium Prospect this week.

East Kirup is located in the Greenbushes region, Southwest of Collie.

LPI Executive Director, Andrew Phillips said ““The results of this drilling program will be used − along with previously completed environmental surveys − to prepare a CMP to allow drilling on new tracks, the commencement of phase three.

The intention is to hit the ground running in 2023, and we are pleased that the commencement of the program is so early in the year.”

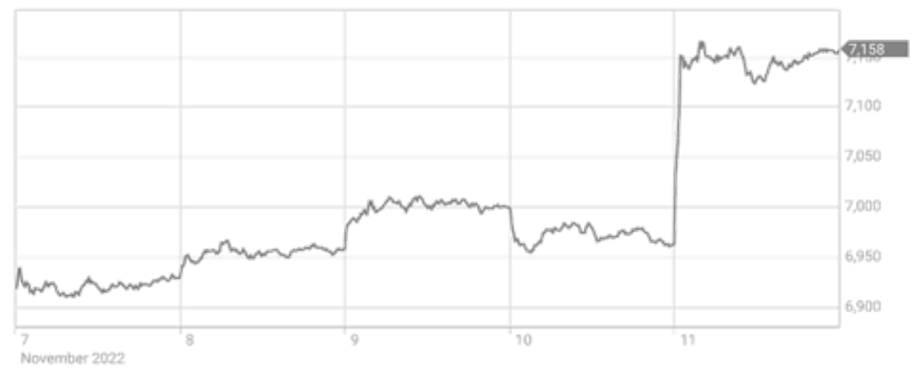

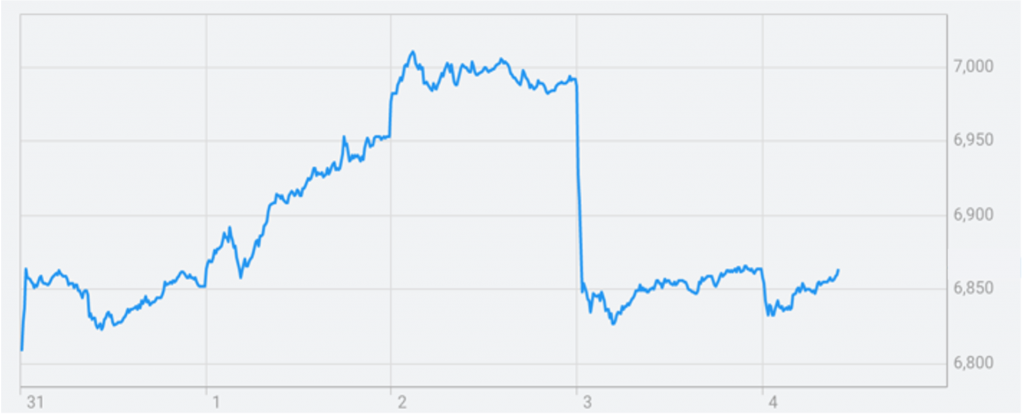

The S&P/ASX 200 started off the week slow at 1,178 points before falling to 7,126 points on Wednesday. The market picked up again, increasing 202 points to finish off at 7,328 points.

The All Ordinaries finished at 7,540 points. The top performing stocks where Poseidon Nickle and Andromeda Metals.

Gold had a slow rise this week, starting at $1,882.00 USD and rounded the week off at $1,898.90 USD at the close of the ASX.

Silver was more turbulent, falling from $24.30 USD to $23.89 USD on Tuesday, raising again to $24.17 USD on Wednesday, then falling again on Thursday to $23.88 USD before finishing off the week at $23.94 USD.