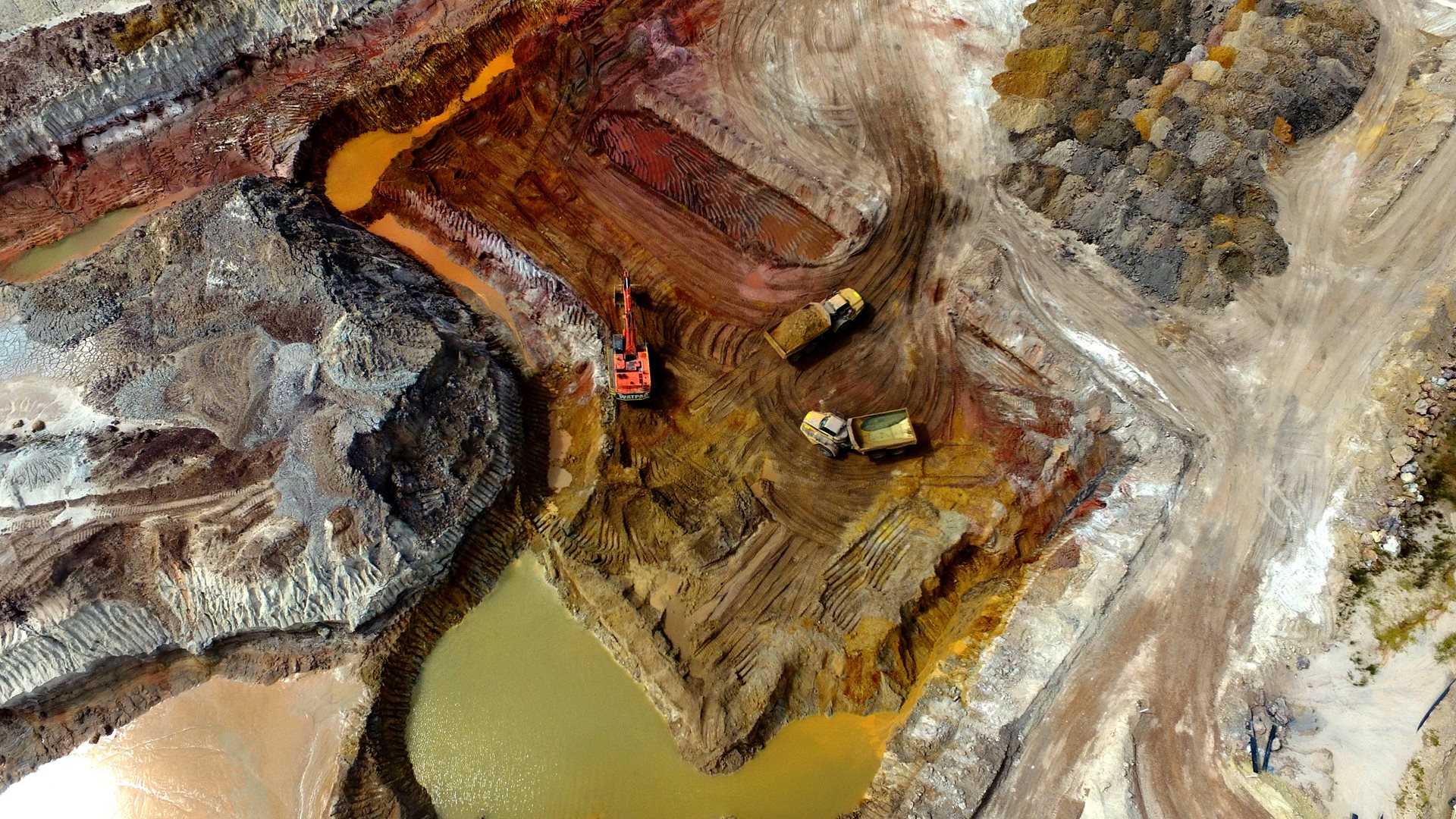

The West Australia government fears heavy rains could wash polluted water from Alcoa mines into the state’s biggest dam, making the water undrinkable.

The US aluminium giant that mines bauxite within 300 metres of the water’s edge at Serpentine Dam changed its methods about five years ago, increasing the risk of sediment flowing into the dam.

If the water was contaminated, it would cost taxpayers up to $2.6b and potentially take years to fix.

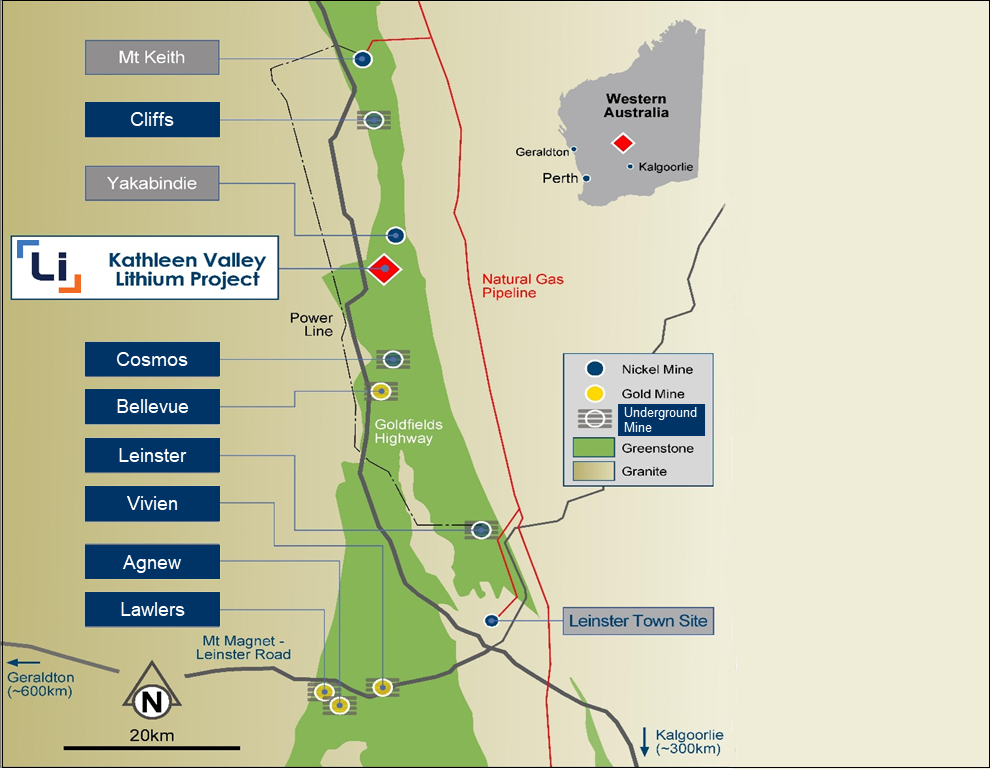

Battery Age Minerals has appointed Nigel Broomham as it’s General Manager of Exploration.

Broomham will spearhead the exploration of its portfolio of international batter metal assets.

Battery Age CEO Gerard O’Donovan said “Nigel is a highly experienced geologist who played an important role in the exploration, development and operation of Pilbara Minerals’ world-class Pilgangoora lithium project,” he said.

“He brings extensive technical geological expertise, strong commercial acumen and considerable energy and enthusiasm – all of which will be invaluable as we embark on our growth journey as a diversified battery metals company.”

Aerison Group has been awarded multiple new contracts for projects in Western Australia and South Australia, totalling $100m.

The projects involve the rare earths, agricultural, green energy and chemicals sectors and includes the Yuri Green Hydrogen project in the Pilbara.

Aerison CEO Giuseppe Leone said “These contract awards are an important step in delivering our industry diversification strategy, with an increasing focus on the critical mineral, agriculture and chemicals sectors.”

Newcrest has received a $24B takeover offer from rival gold miner Newmont.

The offer would entitle Newcrest shareholders 0.38 Newmont shares for ever 1 Newcrest share they own.

Newmont president Tom Palmer said “The proposed transaction would join industry-leading portfolios of assets and projects to create long-term value across the combined global business, and we welcome the consideration of Newcrest’s board of directors.”

Hancock Energy is the sole bidder for the takeover of Warrego Energy after Strike Energy bowed out this week.

Mineral Resources and Beach Energy were both contenders but pulled out last month.

Strick Energy will still walk away with $116m from their shares worth 25.99% voting power.

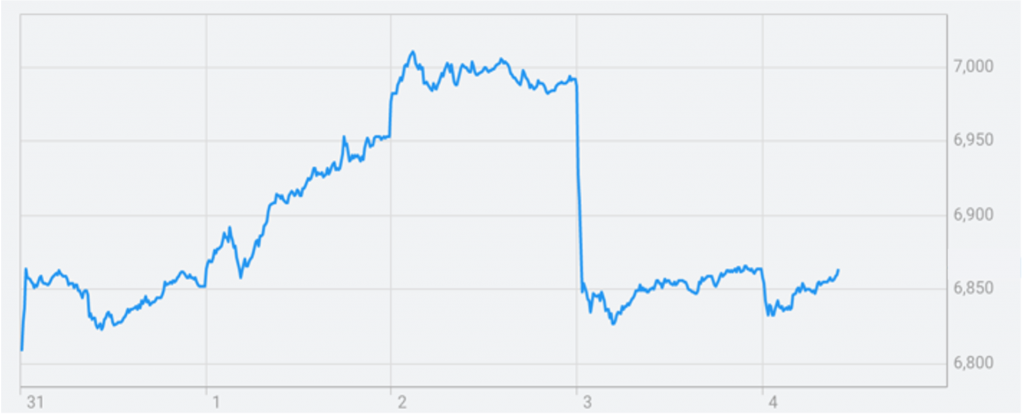

The S&P/ASX200 markets closed lower today after a disappointing week.

Starting off at 7,560 points on Monday, the markets fell throughout the week to end on 7,434 points. The markets still sit 479 points higher than the start of the month.

The All Ordinaries closed lower too, at 7,631 points, though still higher than the last 6 months.

The gold price remained steady after the dramatic fall last week, hovering around $1,875USD, before finishing at $1,866.15.

Silver has remained steady, rounding off the week at $22.34USD.