Gold and the US Election.

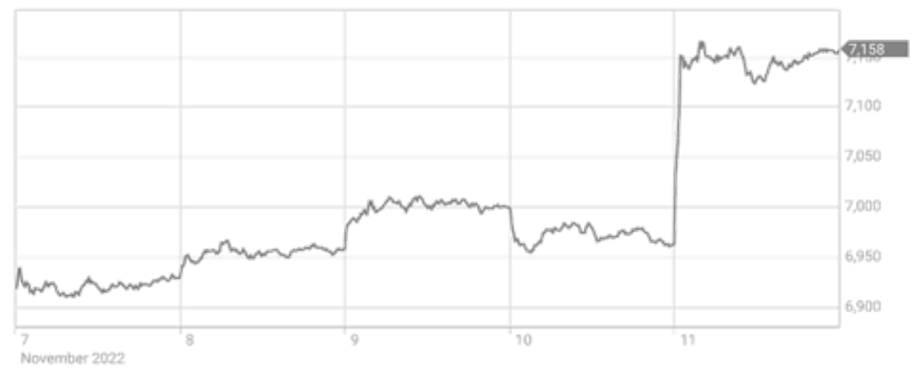

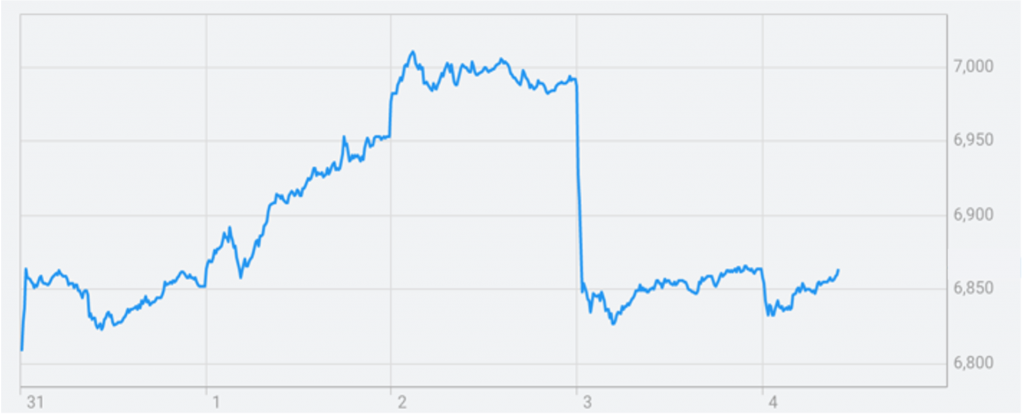

It would seem the gold market has factored in a win to Biden in the US elections with the price of gold rising by about US$40 in overnight trade (Australian time). The Aussie dollar has risen against the greenback to ~US72.6c, which gives an Aussie gold price of ~$2,680.

As I type this Trump is giving a media briefing at the White House where he is claiming that the election has been rigged. He claims it has been stolen from him by fraud. This would seem to flag that more court challengers are on their way if, as expected on current count, Biden wins the required 270 Electoral College votes.

The Dow Jones Index also had a good day and rose 542 points indicating that it is not only the gold market looking upon the expected result favourably. Given that Trump is sure to litigate in his quest to maintain office it will be interesting to see how all markets react to it over the coming weeks

Venture Reports on Results from Golden Grove North.

Venture Minerals (ASX: VMS) has released results from the first drill hole at Orcus which has intersected 33 metres of disseminated to semi-massive sulphides with Copper and Zinc at the Company’s highest priority VMS Drill Target at Golden Grove North. The sulphide intersection sits predominately within a chlorite-sericite altered sequence of foliated mafic volcanic which is a potential host for VMS style mineralisation.

Venture’s Managing Director commented “The first drill hole at Orcus has had immediate success with a strong intersection of sulphides containing Copper and Zinc. Venture eagerly awaits the assays to confirm the highly likely addition of both gold and potential silver mineralisation as it moves onto the next drill holes at Orcus, the Company’s highest priority VMS target at Golden Grove North.”

Venture has completed a visual inspection and preliminary hand-held XRF analyses on the RC chips and has verified the presence of copper and zinc within the pyrite dominated sulphides. Samples are being prepared for submitting to a laboratory for assay to confirm the observed mineralisation. X

The company claims the Orcus prospect already boasts a VMS style drill intersection of 22m @ 0.76 g/t Gold, 0.64% Copper & 1.3% Zinc from 38m to bottom of hole, including 10m @ 1.0g/t Gold, 0.74% Copper & 2.1% Zinc from 50m to bottom of hole, that sits on trend between the two recently delineated high priority VMS drill targets of Vulcan North and Vulcan West.

VRX Silica gets Aboriginal Heritage Nod.

VRX Silica (ASX: VRX) has announced the results of an Aboriginal heritage survey at its Arrowsmith North Silica Sand Project (Arrowsmith North) and Arrowsmith Central Silica Sand Project (Arrowsmith Central), located approximately 270km north of Perth, Western Australia.

The comprehensive archaeological and ethnographic survey was conducted last month with Amangu representatives of the Yamatji Nation and Yamatji Marlpa Aboriginal Corporation (YMAC) personnel over proposed initial mining and critical infrastructure areas.

Preliminary advice received by the Company from YMAC confirms that the Arrowsmith North Access Road, Services Corridor and Production Area are clear for the stated works to proceed for 10 years of production. The Arrowsmith Central Production Area and Arrowsmith Central Infrastructure Areas are cleared for 5 years of production.

VRX’s Managing Director Bruce Maluish said: “With the grant of Mining Leases for Arrowsmith North and Arrowsmith Central expected imminently, obtaining Aboriginal heritage clearance for our proposed works on both projects is an important step forward for their development.

“This continues our strong and supportive relationship and consultative approach with the local Yamatji Nation people and YMAC. We appreciate their efforts in progressing the conduct of the survey and report.”

Eagle Mountain Reports High-Grade Assays.

Eagle Mountain Mining (ASX: EM2) confirmed high grade assays from initial drilling at the Company’s 80% owned Oracle Ridge Mine Project in Arizona, USA.

Eagle Mountain’s intends to build a low-cost mining operation, which involves increasing the resource base both within the current mine area and in the near-mine vicinity. A surface diamond drilling program commenced at Oracle Ridge in early September 2020, designed primarily to target extensions of the high-grade portions of the existing NI43-101 Minerals Resources Estimate.

Assays results from holes WT-20-03 (upper part only) and WT-20-04 (selected zones) have been received and are reported as: 4.56m at 5.28% Cu, 50.7 g/t Ag and 0.77g/t Au from 184m, including 0.93m at 13.05% Cu, 127g/t Ag and 0.32g/t Au

Higher priority sections from four further drill holes have been submitted to the laboratory with assay results from three holes due in November 2020

Eagle Mountain Mining CEO, Tim Mason, commented: “This is an excellent start to our drill program at Oracle Ridge, which targeted zones outside the existing Mineral Resource Estimate (MRE). The intercept of 4.56m at 5.28% Cu, 50.7 g/t Ag and 0.77g/t Au, including 0.93m at 13.05% copper and 127g/t silver is outstanding. The mineralisation in this zone is unconstrained for approximately 100m to the east, with follow up drilling planned to test extensions in this area.

Our goal is to build on the significant high-grade copper MRE, to support a potential future mining operation, with these assay results reinforcing our view that there is significant mineralisation outside the existing MRE at the Project. The drilling program has been extended to the end of CY2020, and we look forward to updating the market with further results over the coming months.”

Lucapa Raise $10 Million to Expand Processing Capacity.

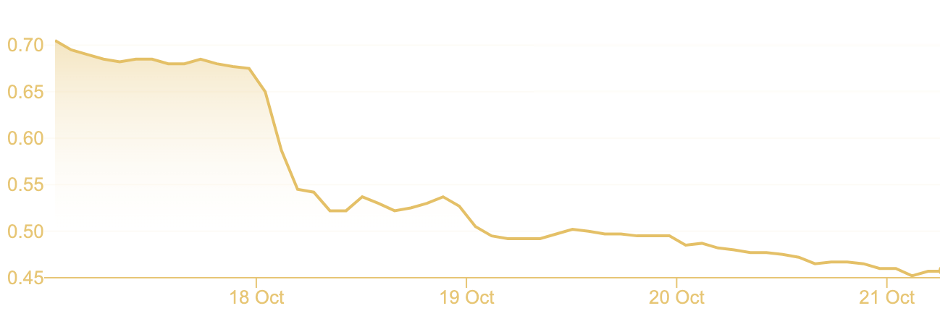

Lucapa Diamond (ASX: LOM) has received firm commitments from professional and sophisticated investors to subscribe for 181,818,182 fully paid new ordinary shares in the Company at an issue price of $0.055 per share to raise $10 million before costs. The Placement involved the issue of 54,824,075 free attaching unlisted $0.08 options, expiring 2 years from the date of issue.

The oversubscribed capital raising, was cornerstoned by Ilwella Pty Ltd, a diversified investment vehicle of the Flannery family office and by Safdico International, a leading multinational diamond company and subsidiary of Graff International. The Company also welcomed new institutional investors to the register.

Lucapa intends to use the funds from the Placement to commission an expansion in the processing capacity of the Mothae kimberlite mine from 1.1Mtpa to 1.6Mtpa (+45%). This should materially increase production, revenues and due to economies of scale, improve unit operating costs and deliver improvements to earnings. The investment in Mothae is expected to cost $8.5 million, with the balance of the funds raised, net of costs, to be utilised for general working capital purposes.

Managing director Stephen Wetherall commented; “We are extremely pleased with the strong support shown by strategic and institutional investors in the value accretive expansion plan formulated by Lucapa and the Government of the Kingdom of Lesotho, our Mothae partner”.

“The Mothae expansion should see a material increase in the benefits derived by the Basotho nation and to our shareholders”.