The start of the financial year continues to deliver news to the market thick and fast.

Develop has entered a trading halt as it looks to acquire Essential Metals. The acquisition is to executed via a binding Scheme Implementation Deed under which Develop proposes to acquire 100 per cent of the issued shares in Essential by way of a Scheme of Arrangement.

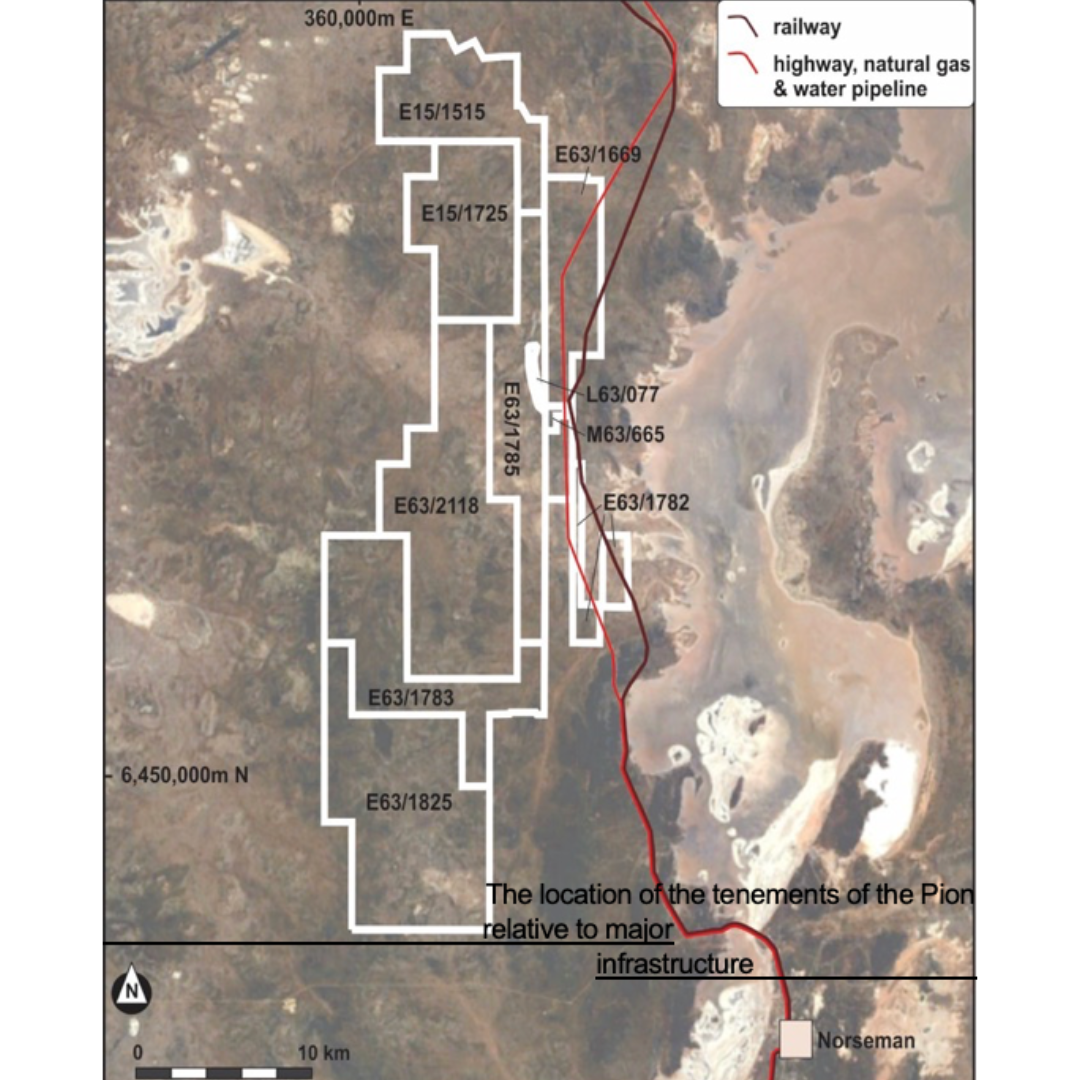

A key piece of this acquisition is Essentials, Pioneer Dome, which is located in WA’s ‘Lithium Corridor’ 130km south of Kalgoorlie. This asset has a Project Feasibility Study underway on it at the moment. Pioneer Dome is a hard rock lithium development asset with a Mineral Resource of 11.2Mt at 1.16% Li2O.

Essential Metals major shareholder Mineral Resources, has thrown its support behind the proposal. Mineral Resources also hold shares in Develop as the second largest shareholder.

The Scheme Consideration is 1 new Develop share for every 6.18 Essential shares held, implying a fully diluted equity value for Essential of ~A$152.6 million and A$0.56 per share based on the closing price for Develop shares of A$3.46 per share on 30 June 2023.

This represents a significant premium of: 34.9% to the closing Essential share price of A$0.415 per share on 30 June 2023;

30.8% to the 20-day Essential VWAP of A$0.428 per share up to and including 30 June 2023;

62.3% to the Essential share price prior to the pre-Tianqi Lithium Energy Australia (TLEA) Scheme price of A$0.345 per share on 6 January 2023 and 12.0% to the TLEA Scheme price of A$0.50 per share