Morning News Bites for September 16. Australian Nurses Union study finds COVID-19 infections in Australia could be nearly 60,000 more than reported, heavy rain forecast for drought-stricken towns in central Australia and Technology Metals Australia announce a life-of-mine update for their Gabanintha Vanadium Project in WA.

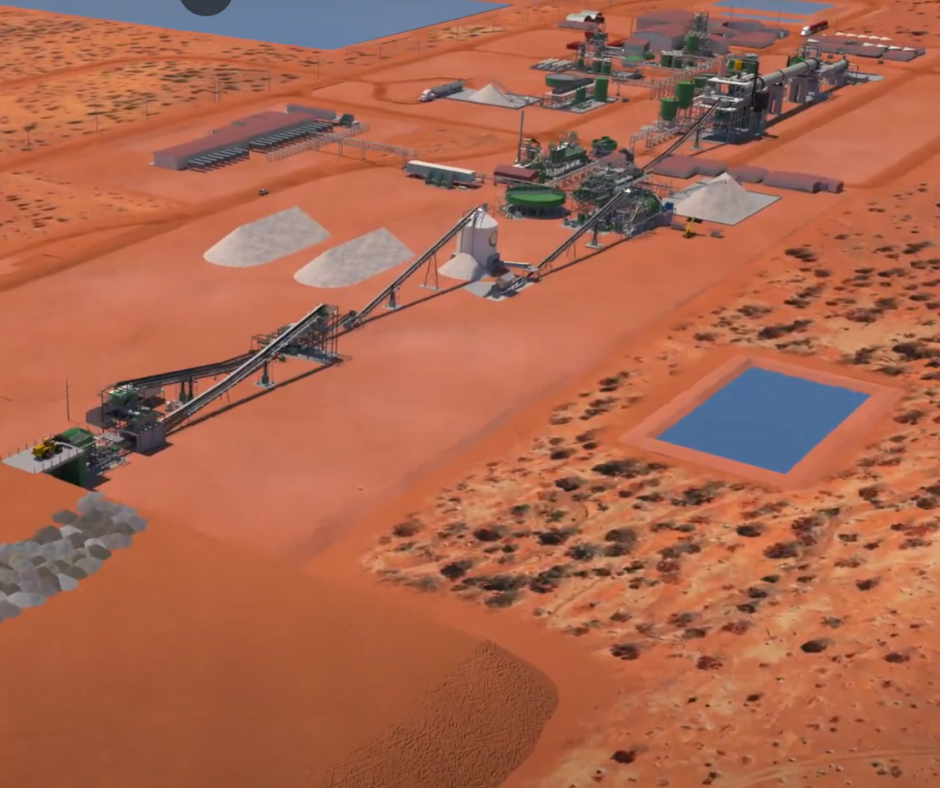

Technology Metals Australia Limited announced an update of the Gabanintha Vanadium Project located 40km south of Meekatharra in Western Australia, with the life of mine operating schedule extended to 22.5 years. The reserve estimate increased to 39Mt at 0.9% V2O5 – a 32% increase on the DFS Ore Reserve, and the Maiden Southern Tenement Probable Ore Reserve with an estimate of 9.4Mt at 0.97% V2O5 – a very high 98% conversion from the Indicated Mineral Resource estimate. Managing Director Ian Prentice commented, saying “The 22.5 year initial project life is expected to be viewed favourably by prospective Project financiers, strategic partners and key stakeholders.”

A large gold target has been identified just 20km from Hemi discovery at Kairos’ Kangan Project in the Pilbara. A large anomalous gold target has been identified, adjacent to major regional structures identified from new aeromagnetic and soil geochemistry data. This target is one of four gold targets identified at Kangan following a recent Ultrafine soil geochemistry program. Heritage surveys and 5,000m of air-core drilling are planned for October/November at Kangan. The Reverse Circulation (RC) rig has completed eight 8 holes for 1,424m at Fuego to date, intersecting broad zones of sulphides (pyrite) in conglomerates, sandstones and black shale.

Great Northern Minerals Limited announced the receipt of the initial four metre composite results from the Reverse Circulation (RC) drilling programme at their Big Rush Gold Project in Northern Queensland. The drilling at Big Rush totalled 22 RC holes for 3,634 metres spread over approximately 900 metres of strike underneath the southern, central and northern previously mined shallow open pits. Drill hole depths ranged from 110 to 250 metres depth and averaged 165 metres. First assays from the drill program have returned high grade results including, 24m @ 3.90 g/t Au including 8m @ 10.57 g/t Au from 140 metres and 32m @ 3.89 g/t Au including 4m @ 18.97 g/t Au from 76 metres.

Rumble Resources Ltd reported that three phases of target generation have been completed at the Munarra Gully Project. The target generation has delineated multiple high priority RC drill targets at the Amaryllis Au -Cu-Ag Prospect located on the Munarra Gully Project, located some 50km NNE of the town of Cue within the Murchison Goldfields of Western Australia. Rumble has now commenced an RC drill program to test the new geophysical (conductors and magnetic) targets that have potential for large-scale Au–Cu–Ag deposits. Previous high-grade gold drill intercepts include highlights of 5m @ 11.67 g/t Au from 161m and 2m @ 13.45 g/t Au from 92m.

A 5,500 metre aircore (AC) drilling program has been announced for Bryah Resources Limited at various prospects within the company’s Basin Project, located in central Western Australia. The aim of the AC drilling program is to complete testing the large soil geochemical anomaly located at Windalah East, and undertake first pass reconnaissance drilling, primarily for gold-copper, at the Wongawar, Fortnum East and Fiddlers East prospects. The program is expected to take 2-3 weeks to complete. Managing Director Neil Marston said, “This is the most substantial drilling program undertaken by the Company this year, these areas have been carefully identified by the company, with in-depth consideration given to encouraging geological information. The new target areas are all highly prospective for gold and copper.”

Northern Star Resources has announced its June quarter update. The KCGM Joint Venture holder has announced its postponed FY20 interim dividend of A7.5¢ to be paid on July 16, 2020 – fully franked. Northern Star also drew down an additional A$200 million in debt in the March quarter but advised the market today it has repaid that A$200 million on July 6 2020. The Jundee Operation produced 80,666oz for the June quarter and 300,150oz for FY20 while Pogo produced 49,353oz for quarter and 174,307 for FY20. The Kalgoorlie operations produced 83,945oz for June quarter and 318,759oz for FY20 which saw overall milled tonnes increasing by 10%, head grade increasing by 4% and gold production increasing by 13% compared to the March quarter. And as reported the KCGM Super Pit focus turned to expanding the available open pit mining front 53,397oz per June quarter and 111,961oz for the FY 20. According to Bill Beament, Executive Chairman Northern Star Resources “The results at our Pogo mine in Alaska were particularly pleasing given the challenging circumstances emanating from COVID-19 where we effectively managed safe operations with 36 confirmed cases through the quarter. Despite the considerable impacts of COVID-19 at Pogo, the underlying trend of rising production and productivity continued. This further demonstrates the huge potential of this asset in more conventional circumstances. The teams at our Jundee and Kalgoorlie Operations excelled and we made strong progress towards our goal of unlocking the significant upside at KCGM.”

Northern Star Resources has announced its June quarter update. The KCGM Joint Venture holder has announced its postponed FY20 interim dividend of A7.5¢ to be paid on July 16, 2020 – fully franked. Northern Star also drew down an additional A$200 million in debt in the March quarter but advised the market today it has repaid that A$200 million on July 6 2020. The Jundee Operation produced 80,666oz for the June quarter and 300,150oz for FY20 while Pogo produced 49,353oz for quarter and 174,307 for FY20. The Kalgoorlie operations produced 83,945oz for June quarter and 318,759oz for FY20 which saw overall milled tonnes increasing by 10%, head grade increasing by 4% and gold production increasing by 13% compared to the March quarter. And as reported the KCGM Super Pit focus turned to expanding the available open pit mining front 53,397oz per June quarter and 111,961oz for the FY 20. According to Bill Beament, Executive Chairman Northern Star Resources “The results at our Pogo mine in Alaska were particularly pleasing given the challenging circumstances emanating from COVID-19 where we effectively managed safe operations with 36 confirmed cases through the quarter. Despite the considerable impacts of COVID-19 at Pogo, the underlying trend of rising production and productivity continued. This further demonstrates the huge potential of this asset in more conventional circumstances. The teams at our Jundee and Kalgoorlie Operations excelled and we made strong progress towards our goal of unlocking the significant upside at KCGM.”