The ASX ended trade on Wednesday with a gain. The market was up 3.5 points.

- Electromagnetic survey has commenced for Galileo Mining’s nickel targets Lantern North and South at Frasers Range. According to Managing Director Brad Underwood, the research over the last 18 months has helped get the company to this point. “We have spent the last 18 months developing our understanding of the nickel potential at our Fraser Range tenements. We now know we have similar host rocks to those at the operating Nova nickel mine, and our first RC drilling program in the area showed disseminated nickel-copper sulphides. The present round of EM surveying is designed to refine our targets for more advanced drill testing.” Once results are known, a drilling program will be scheduled. Shallow aircore drilling at the Lantern Prospect has been completed with 8,839 metres drilled and assays pending.

- An upcoming drill program will test the gravity and new geochemistry targets for Legend Mining at its Mawson prospect. Managing Director Mark Wilson said “The size, strength and location of these gravity highs between the two geochem anomalies makes this a very exciting feature of the Mawson story. The footprint that has now been interpreted, demonstrates the current extent of the large mineralised Mawson system. We have scheduled an RC drill programme to commence as soon as possible, which is designed to provide the geology to help identify the source of the massive sulphide mineralisation which we have already discovered.” Mawson is part of the Rockford Project east of Kalgoorlie and traverses the Trans Australian Railway.

- Havieron drill results have been announced by Newcrest Mining for its project east of Telfer in the WA Pilbara. The results revealed the best significant intercept to date with 109m @ 6.3g/t Au and 0.71% Cu from 668m. The Current drilling is now focussed towards delivering a maiden inferred resource and defining the mineralisation. This is expected in the second half of the 2020 calendar year. Newcrest Managing Director and CEO Sandeep Biswas said, “At Havieron we have returned our best drill result to date and with the step out drilling result we see real potential to further expand this orebody. Getting underground is now the priority and we continue to progress the work to commence decline development by the end of this calendar year or early 2021.”

- There is potential for a significant gold discovery at the Kopai Prospect within the Lake Roe Project, 100km east of Kalgoorlie. Breaker Resources has announced preliminary results from its first 32 drill holes. The highlights include 4m @ 4.54g/t Au from 84m within 9m @ 2.90g/t to end-of-hole in BBRC1373 (ends in mineralisation); There is still a further 28 holes results pending. The drill program by Breaker is to assess and scope the full potential of the 9.5km system.

- JB HiFi has announced a trading update and guidance for the 2020 Financial Year. On the back of an increase to Kogan gross sales, Wesfarmers and Harvey Norman results, JB HiFi has recorded total sales from its Australian, New Zealand and Good Guys operations to be around $7.86 Billion for the FY. The work of the staff during the trying COVID-19 times was pinpointed by Group CEO Richard Murray also when announcing the latest results “I would like to thank our over 12,000 team members who have done an incredible job in meeting the extraordinary challenges faced over the past few months. Our customers have continued to turn to us for their technology and home appliance needs and our team members have responded and adapted in an amazing manner to make sure we can do it safely and effectively.”

Additional resources have been identified 80m north of the pit shell. The focus on the next stage of review will identify Further drilling options and further mining methods. Tim Spencer, Managing Director of Pioneer Resources said Stage 2 would take around three months to complete, but he was quite pleased with the results so far. “The Sinclair Mine paid off handsomely for the Company. While the Stage 2 mine would likely be smaller in scale, it could yield an even higher margin per tonne of caesium oxide extracted and generate additional cash so that we can continue to self-fund our exploration activities for lithium, gold and nickel.” He said.

Additional resources have been identified 80m north of the pit shell. The focus on the next stage of review will identify Further drilling options and further mining methods. Tim Spencer, Managing Director of Pioneer Resources said Stage 2 would take around three months to complete, but he was quite pleased with the results so far. “The Sinclair Mine paid off handsomely for the Company. While the Stage 2 mine would likely be smaller in scale, it could yield an even higher margin per tonne of caesium oxide extracted and generate additional cash so that we can continue to self-fund our exploration activities for lithium, gold and nickel.” He said.

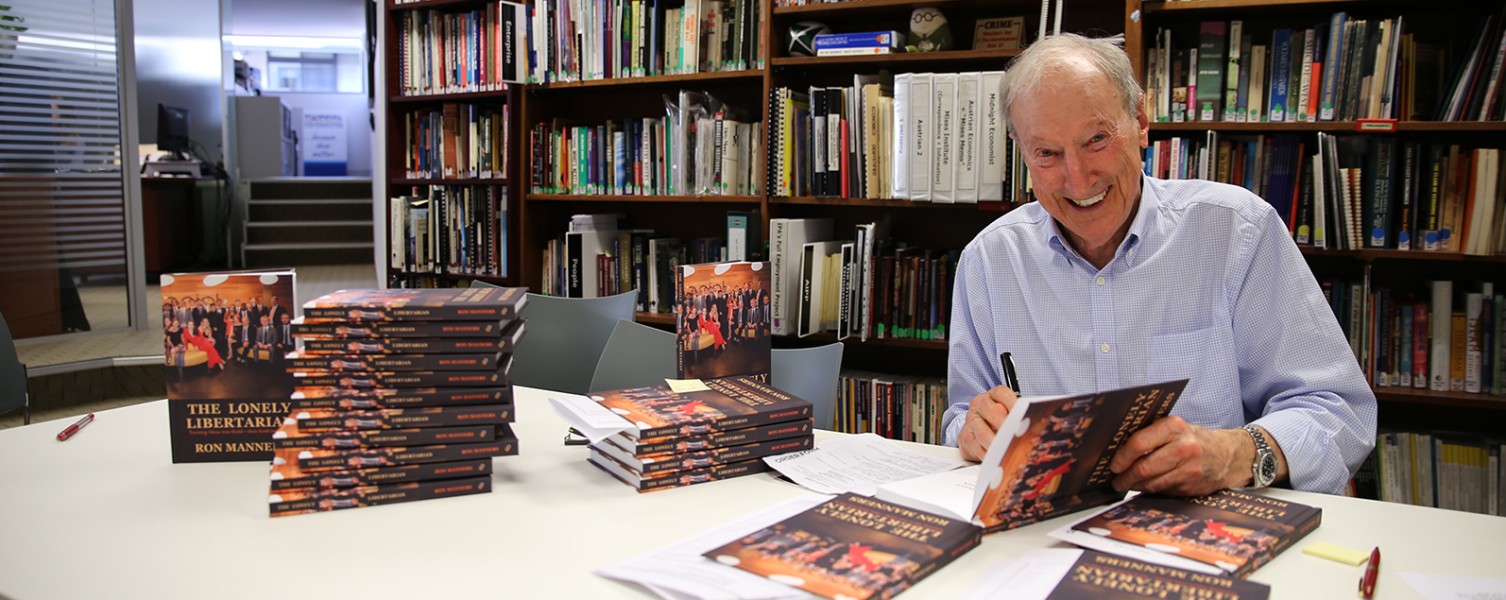

From Kalgoorlie, Mr Manners has been instrumental in the mining industry, floating several mining companies and also inducted as as “living legend” into the Australian Prospectors and Miners Hall of Fame. He has also been passionate about helping students in mining and set up Mannkal Economic Education Foundation, which has awarded more than 1,500 scholarships. While other Western Australian based mining related recipients awarded an AO in the general division include: Denise Goldsworthy for distinguished service to business, particularly to technological innovation and research in the mining and manufacturing sectors; Ms Goldsworthy helped drive the Rio Tinto autonomous truck project as well as being a founder and Managing Principal of Alternate Futures pty ltd. Colin Beckett was also awarded an AO in the general division for distinguished service to business in the energy, gas and oil production and infrastructure sectors, and to tertiary education.

From Kalgoorlie, Mr Manners has been instrumental in the mining industry, floating several mining companies and also inducted as as “living legend” into the Australian Prospectors and Miners Hall of Fame. He has also been passionate about helping students in mining and set up Mannkal Economic Education Foundation, which has awarded more than 1,500 scholarships. While other Western Australian based mining related recipients awarded an AO in the general division include: Denise Goldsworthy for distinguished service to business, particularly to technological innovation and research in the mining and manufacturing sectors; Ms Goldsworthy helped drive the Rio Tinto autonomous truck project as well as being a founder and Managing Principal of Alternate Futures pty ltd. Colin Beckett was also awarded an AO in the general division for distinguished service to business in the energy, gas and oil production and infrastructure sectors, and to tertiary education.