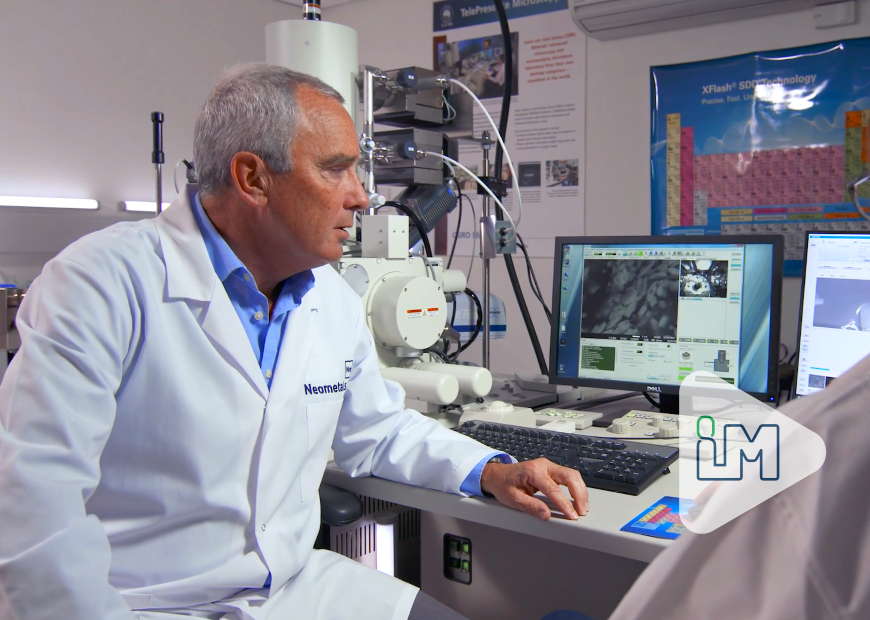

Neometals Completes Mini-Pilot Test Work.

On top of Neometals (ASX: NMT) yesterday announcing its venture into battery recycling it has released details of the successful completion of its mini-pilot test work campaign on the Company’s Vanadium Recovery Project. Results confirmed excellent vanadium chemical product purity (>99.5% V2O5), strong recoveries (>75%) and reduced residence time for Neometals’ patent pending hydrometallurgical process for recovering vanadium from Slag.

Neometals executed a collaboration agreement with Critical Metals, to jointly evaluate the feasibility of constructing a facility to recover and process high-grade vanadium products from vanadium-bearing steel by-product in Scandinavia.

The Mini-Pilot was constructed, commissioned and operated continuously through the campaign without any safety incidents or process challenges. Of particular significance was the achievement of chemical-grade vanadium pentoxide at high recovery rates and low residence times. Passing this major technical milestone is important and gives Neometals the strong confidence to continue its project development by commencing the PFS.

Neometals Managing Director Chris Reed commented: “We are very pleased with the results of the Mini-Pilot campaign. This substantially de-risks our patent-pending processing flow sheet and gives us the confidence to commence the PFS. We now shift our attention to the design phase of the larger proposed pilot plant which will leach material from three of SSAB’s steel operations in a mild carbonate solution at moderate temperatures and atmospheric pressure. The beauty of our process is that the main reagent is carbon dioxide, which we plan to capture from third-party emission to sequester some 65,000 tonnes in our leach Residue rendering it inert and available for secondary use.”

Marmota Strikes it Rich.

Marmota (ASX:MEU) has announced that the drilling program completed in September 2020 at Aurora Tank has achieved multiple successes.

Marmota Chairman, Dr Colin Rose, said: “ This has primarily been an extensional program, testing out new ground. It is also Marmota’s eighth drilling program at Aurora Tank. We are very fortunate that every one of those programs so far has been a success.

This program has yielded new high-grade extensions to the North, West and at depth, significantly extended the NW flank, and yielded our current highest 4m intersection. I am delighted that Aurora Tank keeps on growing, that underlying fundamentals are strong, and so too the potential rewards to shareholders.

Aurora Tank is fortunate to combine high-grade intersections that are close to surface, with excellent metallurgy, making Aurora Tank potentially amenable to low-cost low capex open-pittable heap leach methods, which are our clear focus. ”

Drilling yielded outstanding high-grade gold intersections including: 4m @ 70 g/t gold (from 64m downhole) and 4m @ 25 g/t gold (from 52m downhole).

Marmota has intersected very high grades close to surface [typically just 20m to 50m from surface], this program is also the first time that Marmota has also intersected high grade gold at depths below 80m. In particular, a reconnaissance hole designed to test for an extension to the west of the NW flank intersected 4m at 7.3 g/t at a depth of 120m downhole with follow up drilling required to prove it up.

Strandline to Power Up with Contract Power.

Strandline Resources (ASX: STA) has released details of its development of its Coburn mineral sands project in Western Australia by appointing Contract Power Australia as preferred contractor to build, own and operate the power generation facilities for the project.

Coburn’s purpose-designed power facility is based on a low-cost, low-emission solution integrating natural gas fuelled generation with state-of-the-art solar and battery storage technology. The proposed power solution will enable Strandline to capture energy supply cost savings relative to the DFS published in June 2020.

The power station is designed for a maximum demand capacity of 16 MW and average consumed power of ~10 MW. Natural gas will be supplied by others under an industry standard long-term LNG supply agreement and trucked to an on-site storage and re-vapourisation facility supplied by Contract Power. The LNG then feeds a set of efficient engine generators on an N+1 basis and has ~30% solar (renewable) penetration for the major stable loads.

Generation is at 11kV with step up to 22kV for power transmission to the project loads across the mine site.

Strandline Managing Director Luke Graham said the appointment marked another key step in its strategy to bring Coburn into production and establishes an important relationship with Contract Power, a leader in sustainable clean energy generation in Western Australia.

Pantoro Confirms Two High-Grade Lodes.

Pantoro (ASX:PNR) advised that further drilling and initial level development have confirmed the presence and continuity of two additional high grade lodes at the Wagtail Underground Mine at their Halls Creek Project. Both lodes extend the mineralisation at the Wagtail Underground Mine and are located in the hanging wall of the current Rowdies ore system.

Development and drilling defined a North East oriented splay lode (REV Lode) developing off of the current Rowdies lodes. The new REV Lode currently has a strike length of 50 metres and vertical extent of 100 metres. The lode remains open at depth and drilling is ongoing.

The REV Lode interacts with the newly discovered high grade North Striking Lode in the hanging wall. The sulphide rich REV Lode appears to be a direct analogue to the Mother/Darcy lodes at Nicolsons, where significant upside was realised in the early stages of the projects development.

Managing Director, Paul Cmrlec said: “The discovery of these new lodes is great news for the Wagtail mine, and for the Halls Creek Project as a whole. The splay lodes at Nicolsons provided significant value to Nicolsons mine, and this discovery has the potential to provide the same upside at Wagtail.

The deepest drilling in the lode has returned some of the most exciting results to date, and the team at Halls Creek eagerly awaits the development of additional drilling platforms to enable the full drill out of this lode.

In addition to REV Lode extensions, we continue to test the existing lodes outside of the current Mineral Resource envelope and look forward to reporting extensions to mineralisation which may further increase the mines life.”

Horizon Cracks Good Grades at Crake Project.

Horizon Minerals (ASX: HRZ) announced further excellent high-grade drilling results from the 100% owned Binduli gold project area located 9km west of Kalgoorlie-Boulder in the heart of the Western Australian goldfields.

The announcement comes off the back of a 29-hole, 2,460 metre drilling program that drilled to a depth of 144 metres at their Crake and Coote projects. In particular the Crake project showed encouraging results with grades nearing 20g/t in some holes. The current Mineral Resource Estimate for Crake stands at 1.27Mt @ 1.82g/t Au for 73,820oz at a 1g/t Au lower grade cut-off and remains open to the north, west and at depth.

Commenting on the latest drilling results, Horizon Minerals Managing Director Mr Jon Price said: “Binduli has become an outstanding emerging gold camp with Crake continuing to grow in scale and quality and the adjoining Coote deposit now firming up to have similar potential. Both projects remain open with extensional RC drilling underway and we look forward to further drilling results this quarter from multiple rigs currently operating across the wider project area.”